Every owner of a holiday property has different financial goals. We’ve touched on this in our post about establishing a holiday rental business plan but in this post, we are going to be talking about more general financial goals for your holiday rental business.

If you’re looking for more in-depth information about pricing your holiday rental property, we’d recommend heading over to our revenue management best practices blog post.

Read on to see what the OVO Network team suggest about setting financial goals for your holiday rental business before you get started…

1. Research Your Costs

Before you know what is a realistic financial goal for your holiday rental business, you need to be aware of your costs.

Be aware that the local going rates for services in the area in which your second home is located, may not be the same as where you live. Some areas charge more for services such as cleaning and maintenance and it’s vital that you do your research before setting your goals.

Make sure to look after the team managing your property and your guests respectfully – they are the local face of your business, and the way they set up the property and deal with any problems can make or break your holiday rental business. Your business will not work without them!

2. Decide On Your Profit Margin

Next, decide on the profit margin you want to make – is the total amount viable given the amount of weeks available to guests?

Consider whether demand is higher for some weeks than for others or if rates and demand stay the same year-round.

Find out where most of your guests come from and if there are any implications to the booking calendar (ie school holidays may differ in different countries/regions).

Make a note of any events in your area that normally draw in large crowds. Work out if your property will appeal to spectators, or not.

For example, some of the properties we work with appeal to spectators of the Tour de France as they are often located along the route. This means that owners of these properties can tap into the cycling market for example.

3. Evaluate The Risks

Just like with any business venture, there are associated risks.

By keeping the pricing low you may secure more bookings, which will entail more overheads and more wear and tear. If you set the pricing high, you may take fewer bookings, yet make the same as others who have more frequent, but lower-valued bookings. If the pricing is too high, you may put guests off entirely.

Decide how far in advance you can get your pricing live. Some guests book their holiday months in advance, so aim to get your pricing live in advance to be able to meet demand. Remember that it may take a season or two to get the pricing spot on.

Be aware of how your property pricing compares with others locally. Stay realistic about the number of weeks you might sell, and the demand that exists for those periods.

Monitor pricing, enquiries, local demand and bookings, and be reactive!

These tips simply scratch the surface of managing the financial side of your holiday rental property.

As we mentioned earlier in the post, our revenue management blog post delves deeper into costs, pricing and income. If you’re ready to find out more, take a read of it here.

How much could you earn?

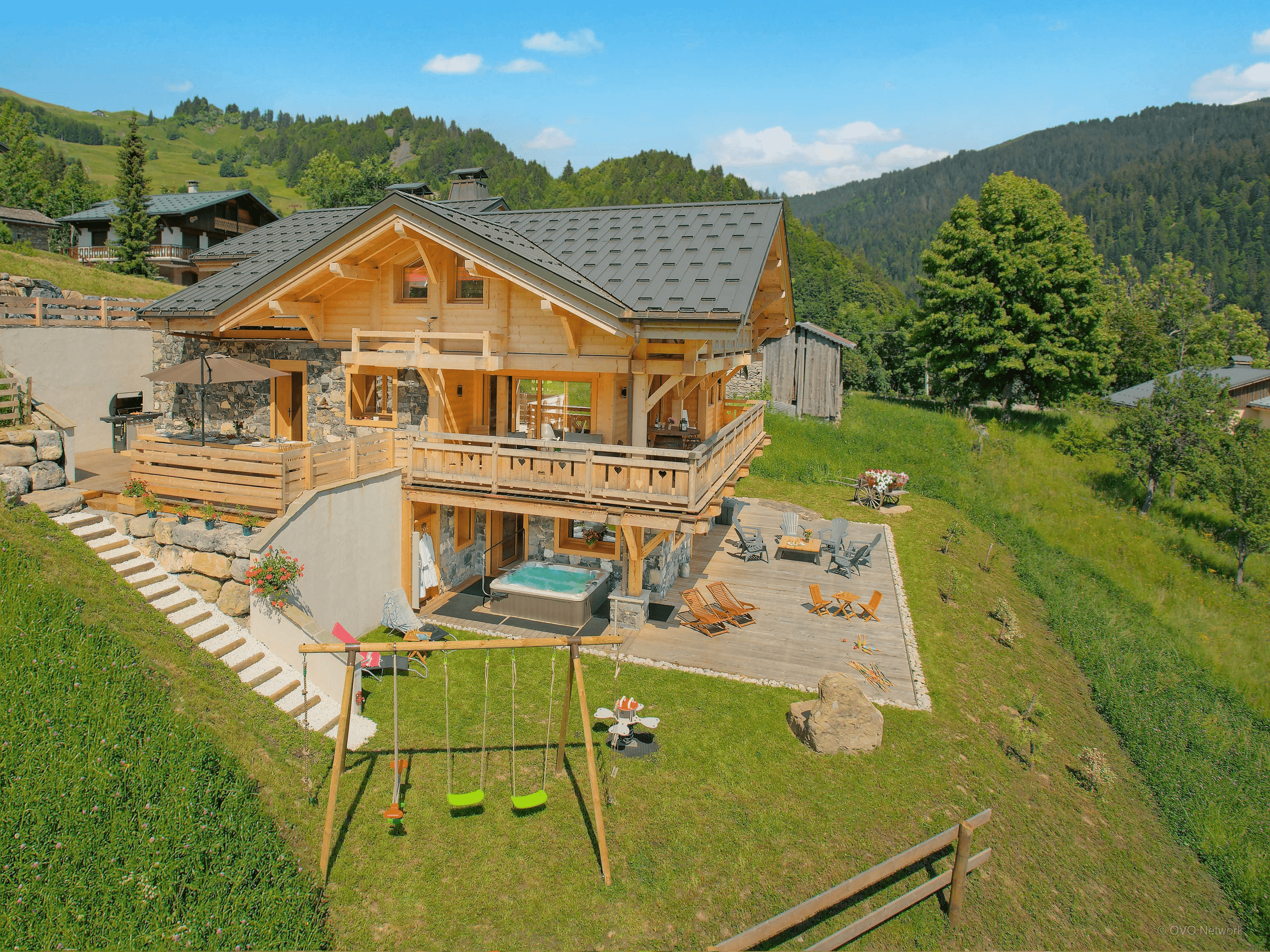

Find out how much your chalet could earn from holiday rentals with our rental return calculator…